By Paul Ejime

The decision by the Federal Executive Council (FEC) directing the Nigeria National Petroleum Company (NNPCL) to sell crude oil to local refineries in Naira, the local currency instead of the US dollar is expected to make petroleum products more available in the oil-producing country which has relied on imports for decades with sporadic product shortages.

Proper implementation of the decision could also ease the foreign currency pressure on the Naira.

However, oil industry sources said on Tuesday that the benefits will only be optimised if the bottlenecks of mismanagement and corruption are overcome.

According to the sources, local refineries were required to buy crude oil in dollars using International Letters of Credit (ILC) through offshore Correspondent banks abroad, for onward payment to the Nigerian government, through NNPCL.

With the FEC’s decision on Monday, Afreximbank and other settlement banks in Nigeria are to facilitate the crude oil transactions between the NNPCL and the local refineries, thereby eliminating the need for ILC to ease pressure on the demand for the dollar.

The Dangote Group, owners of the largest single-train refinery in the world, located in Lagos were yet to respond to the FEC decision by the time of filing this report.

Industry sources, however, said in Lagos on Tuesday that the Group will most likely see the decision as a good gesture by the government.

Official figures show that at least 27 private refineries were issued operating licences by the Nigerian Upstream Petroleum Regulatory Commission (NUPRC) formerly the Department of Petroleum Resources (DPR).

But Dangote’s US$20 billion, 650,000 barrels per day, integrated Refinery is the only one ready to start operation.

Nigeria’s four state-owned refineries are dysfunctional due to mismanagement and corruption, so all hopes are on the Dangote facility to end the embarrassing bouts of petroleum product shortages in the oil-producing country.

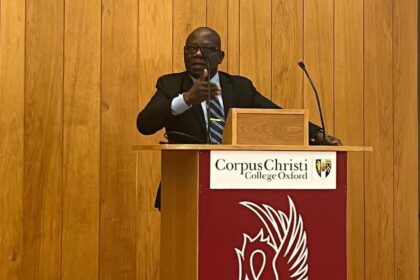

Zacch Adedeji, Chairman of the Federal Inland Revenue Service, told journalists after Monday’s FEC meeting that the government measure would assuage the strain on the country’s foreign spending and stabilise the pump price of petrol, diesel and other petroleum products.

He said the FEC decision would facilitate the sale of refined products from the local refineries to marketers, to boost the availability of locally refined oil products for domestic consumption.

President Bola Tinubu, in charge of the Petroleum portfolio, was quoted directing that 450,000 barrels of crude meant for domestic consumption should be offered in Naira to Nigerian refineries, using the Dangote refinery as a pilot.

The government will determine the exchange rate of Naira to the dollar for the transaction.

Fuel prices have risen in Nigeria by more than 100% after the government announced the removal of oil subsidy last year resulting in spiralling inflation and high cost of living.

Officials from various government agencies, including the police and the armed forces have been holding emergency meetings and rehearsing appropriate responses to the “Hunger” and “Bad Governance” national protests planned by some civil society groups, particularly the youths from 1-10 August.

The Dangote refinery’s originally scheduled date to start operation early this month (July) has passed, overshadowed by controversy and allegations that International Oil Companies (IOCs), were frustrating the refinery’s requests for locally produced crude as feedstock for its refining process. This resulted in the refinery sourcing crude from abroad.

The controversy, characterised by the trading of accusations, took a new turn recently with the Nigerian Upstream Petroleum Regulatory Commission (NUPRC), accusing the Dangote Refinery of producing low-grade products, an allegation vehemently dismissed by the Refinery.

Last week, the Minister of State for Petroleum Resources, Heineken Lokpobiri, hosted a mediation meeting attended by Aliko Dangote, President of the Dangote Group and officials of the Nigerian Midstream and Downstream Petroleum Regulatory Authority (NMDPRA), the NUPRC, and the NNPCL to iron out the differences.

The FEC was, however, silent on another controversial issue – the composition of the Dangote Refinery’s share capital. The NNPCL was said to have expressed an interest in owning 20% of the shares, but the Dangote Refinery said the state-owned petroleum company has only paid for 7.2%. ##

![]()